SURAJ NANDREKAR

PANJIM: Since 2012, Goa has been hearing of the Rs 35,000 crore mining scam, which is double the size of the State’s budget. But the State has made no attempt to recover the loot. The Supreme Court has also passed strictures against the State on the recovery of Rs 3,400 crore due to alleged illegal mining but the State continues to drag its feet.

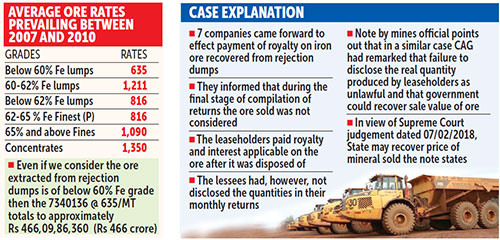

Herald now has in its possession new RTI documents which reveal that the State has to receive a minimum of Rs 466 crore – considering the ore in reject dumps is below 60% Fe, which had an average market rate of Rs 635 per tonne from 2007-10 – if not more from seven mining companies for exporting 73,40,136 WMT ore extracted from rejection dumps.

Considering the situation, wherein the State is borrowing from the market on a regular basis for payment of salaries, Rs 466 crore could solve many problems but only if the Goa government acts on the recoveries.

The case is regarding Salgaocar Mining Industries, Sova, Zarapkar Parcar, Cipriano D'Souza, S Kantilal & Co Ltd, Marzook & Cadar Pvt Ltd, Shantilal Khushaldas & Bros Pvt Ltd and Salitho Ores Pvt Ltd who vide letters dated October 6, 2010 at pages 1/C to 40/C) came forward to effect the payment of royalty on the iron ore recovered from rejection dumps.

“It was informed by them that during the final stage of compilation of returns filed by the company, during the period 2007-08, 2008-09 and 2009-10, the ore sold was not considered. The leaseholders have paid the royalty and the interest applicable on the above mentioned ore after it was disposed of. The total quantity disposed was 7340136 WMT,” reads the note dated January 14, 2019 by the Assistant geologist, DMG.

It added that the lessees had not disclosed the quantities in their monthly returns.

“However, in similar cases of the above lessees for the period 2006-07 the CAG in its report has remarked that the failure to disclose the real quantity produced by the leaseholders as unlawful and that under Section 21(5) of the MMDR Act, 1957, the State government could recover the entire sale value of the iron ore disposed of by the lessees. Show cause notices have been issued to the lessees for the period 2006-07 in that case,” the note reads further.

Moreover, it says, similarly in the cases and in view of the recent judgement of the Supreme Court dated 07/02/2018, the State may recover the price of the mineral sold as per Section 21(5) of MMDR Act, 1957. Accordingly, show cause notices have to be issued.