Team Herald

PANJIM: Ahead of the Budget 2023-2024, the expectations from the industry and the experts in the field of finance are high. The Goa Chamber of Commerce and Industry (GCCI) Taxation Committee has submitted around 50 suggestions and recommendations in a memorandum to the Union Finance Minister.

They include macro-level reforms, rationalisation of tax rates and threshold limits and addressing litigation and processing issues. There are also suggestions relating to the tourism sector, real estate sector, EoDB, interest, penalties, dividends, start-ups, etc.

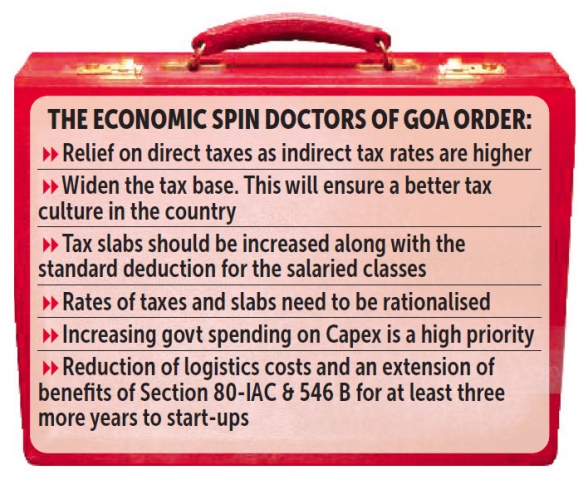

Chartered Accountant Parimal Kulkarni, a practicing professional believes that most taxpayers are paying two taxes, such as indirect taxes on goods and services and direct taxes on income. “Tax matters both for businesses and individuals. It is important that since indirect tax rates are higher, relief on direct taxes be allowed. Given the buoyancy in indirect tax collection, it is pertinent that the reliefs on direct taxes flow in rates and slabs on direct taxes. Further, recognising tax-paying citizens with noticeable public welfare measures is not only important, but also necessary. It is also essential to widen the tax base. This is will ensure a better tax culture in the country,” Kulkarni added.

The pharmaceutical industry in Goa is one of the biggest industries, which contributes nearly 12 per cent of the total pharma products in the country. Goa Pharmaceutical Manufacturers Association (GPMA) president Praveen Khullar expects, “More government incentives for formulation business and R&D, elimination of GST on medicines, the inclusion of more products under PLI (Production linked Incentives) scheme.”

During the Covid-19 pandemic, the health sector was put under the test and the pressure on this sector was huge. Specialist in healthcare for seniors, Rohini Gonsalves believes that in a post-Covid-19 world, health is an even bigger national agenda than defence.

“While the government may have done a whole lot in terms of vaccination yet establishing robust primary healthcare facilities across the country should be of paramount importance. Special facilities including home healthcare for disabled, geriatric, and terminally-ill persons should be made available. Health insurance should be accessible and affordable to even aged persons and families with senior citizens. Paramedical training to support the healthcare infrastructure in cases like the pandemic should be strengthened. Medical equipment and consumables manufacturing should be given special incentives. Much more needs to be done to encourage research in AYUSH streams of treatment, especially for terminal illnesses.

Incentives should be provided to preventive medicine and health-wellbeing industries,” said Gonsalves.

Chartered Accountant and former GCCI president Sandip Bhandare informed Herald that Union Finance Minister Nirmala Sitharaman will be presenting her fifth budget and the third after the Covid-19 pandemic.

“This is also the last full budget before the general elections of 2024. My key expectations are three: (a) Spurring consumption, especially of the middle class; (b) Increasing employment opportunities and (c) Containing fiscal deficit,” said Bhandare.

He further added that a review of the recent results of consumer goods companies reveals a decline in consumption of rural and middle class Indians. In order to spur this consumption, it is essential that the basic tax slabs are increased along with the standard deduction for the salaried class. Further, the rates of taxes and slabs need to be rationalised. This will leave more money to rural and middle-class Indians and will spur more consumption.

“The Government spending on infrastructure, be it roads, ports, bridges is the largest creator of employment and has a multiplier effect. If the high population of young Indians in India has to yield demographic dividends, then increasing government spending on capex is a high priority. During the Covid times, fiscal prudence was relaxed and rightly so. India has been comparatively very conservative in terms of giveaways during the Covid period. The finance minister has to keep fiscal prudence in mind if the inflation has to be controlled,” expected Bhandare.

Rajkumar Kamat, Executive Director of BNI Goa, which has over 600 small and medium-scale business entities in Goa said, “I believe, there is an urgent need for an additional mechanism to refinance MSMEs and get them easier access to credit. This can be done by providing sector-specific relaxation in the classification of loans and extended periods for repayment through a mechanism wherein retail loans to small businesses are treated differently than loans to large corporate houses.”

Goa State Industries Association (GSIA) president Damodar Kochkar echoed the same sentiments as Kamat. He said he wants effective interest rates on MSME finance to be reduced to around 4 to 5 per cent by introducing an interest subvention scheme.

Meanwhile, Rajkumar Kamat further added that besides affordable finance we look forward to the finance minister coming up with a reduction of logistics costs, an extension of benefits of Section 80-IAC & 546 B for at least three more years to start-ups. Introduction of GST amnesty scheme in view of genuine disputes that have come up due to differing interpretations initial to technological hiccups and inability to revise GST returns.