Team Herald

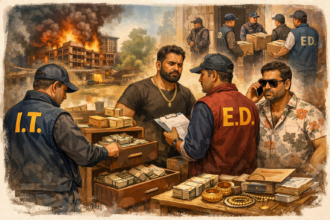

PANJIM: The Commercial Tax Department has begun a crackdown on defaulting firms, which have avoided paying tax to the government under various Acts. These firms have now found their bank accounts frozen.

The department has identified 77 such firms from whom around Rs 120 crore is recoverable in the form of tax, interest and penalty. Sources said these recoveries are outstanding under various Acts like VAT, CST, Luxury Tax, Entertainment Tax, Entry Tax, etc, administered by the department.

“As a first step, various bank accounts of these firms have been frozen. The banks have been directed to deposit the amount available in those accounts to the tune of the liability to the State Treasury by following the process prescribed in the law. These defaulting firms include a number of sole proprietorships, limited liability partnerships, partnership firms, private ltd companies, etc,” it said.

Further action will be taken to recover the money through various other modes.