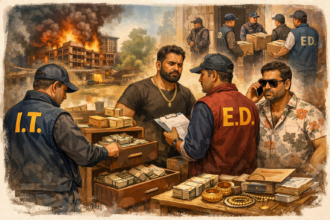

PANJIM: Four Goans were among 498 Indians named as having bank accounts in tax havens such as British Virgin, Cayman and Cook Islands and Singapore. The US-based International Consortium of Investigative Journalists (ICIJ), which this weekend released the names of 10,000 account holders worldwide, said these mega rich use covert companies and bank accounts to shift money and “use complex offshore structures to own mansions, yachts, art masterpieces and other assets, gaining tax advantages and anonymity not available to average people.”

The exposé ~ ‘Secrecy for Sale’ ~ saw the ICIJ release the names of 498 Indians and several Indian companies having such bank accounts. The investigative piece’s key findings have been that government officials, their families and associates are countries such as Azerbaijan, Russia, Canada, Pakistan, the Philippines, Thailand, Mongolia and India.

According to the findings many of the world’s top’s banks have worked to provide their customers with companies that are cloaked in secrecy in the British Virgin Islands and other offshore hideaways as accountants, middlemen and other operatives help offshore patrons shroud their identities and business interests, as well as provide shelter in many cases to money laundering or other misconduct.

Ponzi schemers and other large fraudsters too are seen to have routinely used offshore havens to move their ill-gotten gains.

India has been hit by the black money syndrome ~ as it is known in this country ~ and there have been agitations by many NGOS to try and force the government to release names of such account holders who evade tax. But till date, there does not seem to be enough political will to nail these tax evaders.