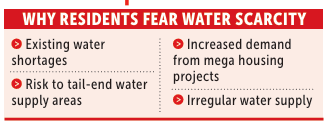

Panjim: Nearly two lakh aggrieved account holders and depositors of Mapusa Urban Cooperative Bank of Goa (MUCB), with depositor’s funds amounting to Rs 355 crore, frozen for last five years and over due to the Reserve Bank of India (RBI) curbs and embargo are unhappy and livid with the prolonged delay in sorting out their issue.

In a press release signed by the depositors Joseph Carneiro, Prabhakar Salgaonkar and Arun Khaunte charged the liquidator Dawlat A Hawaldar for “unethical practice” towards the liquidation proceedings of the now defunct Bank, which has 24 branches in the state of Goa. The MUCB banking license was cancelled by the Reserve Bank of India on April 16, 2020 and the liquidation proceedings were set in motion on April 24, 2020 on appointment by the Central Registrar, New Delhi, of the liquidator Daulat Hawaldar. The enormity of the financial irregularities by MUCB, were of such a magnitude, making it the first bank in the history of the State of Goa till date, to have the banking license cancelled.

The release added that the liquidator as per RBI guidelines is empowered to register complaints with the Economic Offense Wing (EOW) and Enforcement Directorate (ED). On that note, they elaborated how, RBI being the Superior banking authority, in its audited reports has clearly indicted the MUCB of serious financial irregularities detrimental and prejudicial to the interests of depositors, which the liquidator miserably failed to cite and take note of for reasons best known to him.

The depositors referred to how similar bank offences in Maharashtra had culminated in the arrest, imprisonment by the ED and EOW of the culprit Chairman, General Manager and Board of Directors, followed by seizure of their assets and recovery and disbursement of funds, now in progress as in the case of Punjab and Maharashtra Cooperative Bank.

“Unfortunately here in Goa, the culprits responsible for similar banking frauds are still at large and scot-free without shame or fear of any authority,” they added.

At the first-ever meeting to materialize with the liquidator on October 27, 2020, after over six months of Hawaldar’s appointment, a delegation of depositors presented a copy of a petition to the liquidator, with copies addressed to the RBI, Panjim and Mumbai and to the Ministry of Finance, New Delhi.

At the said meeting the liquidator and the Clarification Officer, Shailendra Sawant, were also requested to furnish the list of MUCB defaulters as per Orders of the Supreme Court (SC) vide RBI Notice 3736/10/21 to all banking institutions in India, directed to comply SC orders that loan defaulters names be made public.

The depositors, which issued the press release at the said meeting demanded that a notice be published in the local dailies informing the depositors about the retirement of the Liquidator Daulat Hawaldar from public service with the State government of Goa with effect from September 30, 2020 but continues as a liquidator of the MUCB.

The liquidator had also agreed to make himself available to the depositors at the MUCB Panjim Branch between 11 am to 1.30 pm every Tuesday. This was assured to be published for the benefit of depositors. Of the total 24 MUCB branches throughout the State of Goa, 15 branches are contracted on lease. The continued rentals of these 15 branches, salaries of the staff, electricity bills and other utilities are an additional financial burden the liquidator has failed to act upon, said the release.

The depositors of MUCB have demanded that the liquidator should immediately set in motion liquidation proceedings, i.e., the process of paying the depositors of MUCBL as per the DICGC Act, 1961, wherein every depositor is entitled to repayment of his, her deposits up to a monetary ceiling of rupees Rs five lakh.

Further, the depositors having deposits in excess of Rs 5 lakh with the bank should be reimbursed on finalizing valuation of assets, buildings and various liabilities in possession of MUCB.

“The depositors who have patiently suffered since the last five years and over, pray that the process of recovery, including seizure of assets of those responsible for the consistent blatant irregularities and fraud, be expedited for the recovery of the public funds at the earliest,” the release added.