SURAJ NANDREKAR suraj@herald-goa.com

PANJIM: The countrywide lockdown in the first quarter of the financial year appears to have cost the State dearly as due to the sharp decline in revenue collection the State had to resort to borrowings amounting to Rs 900 cr.

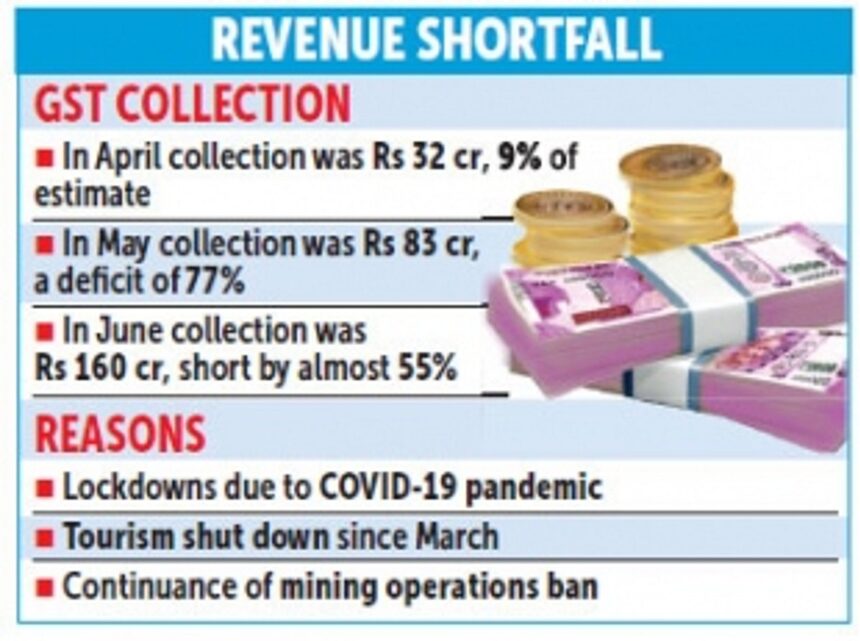

Information reveals that while the national average of revenue deficit (GST, VAT collections) is 59 per cent, the State’s deficit is a whopping 74 per cent.

Sources revealed that the GST collection in April, when there was a total lockdown, was just 32 cr, which was just 9 per cent of the actual estimated collection. Hence the deficit was 91 per cent. In May, when the lockdown began to ease, there was a slight increase in the collection, which was Rs 83 cr, still a deficit of 77 per cent. June saw the collection almost double to Rs 160 cr, but yet fell short by almost 55 per cent.

In a bid to overcome the shortfall the State had to borrow Rs 900 cr even as the State’s pending GST compensation was Rs 933 cr with the Centre. Sources revealed that the State’s protected revenue, as per GST, is Rs 350 cr and any shortfall is compensated by the Centre.

When contacted, State Finance Secretary Daulat Hawaldar confirmed the shortfall in revenue collection but said it was due to tourism. “Every year tourism arrival is more than five times of Goa’s population contribution and since tourism has come to standstill revenue will obviously come down,” he said

He added that the revival of tourism is crucial for the State economy and State finances, which are different.

Asked about the increase in borrowings, he replied, “If there is no revenue we have to borrow. We have Rs 933 cr GST compensation pending with the Centre which is expected in the near future. But since the problem is countrywide we cannot say give us now. The Centre has increased the State’s borrowing limit to meet the expenditure,” he said.

He further stated that the borrowing limit has been increased from 3 per cent to five per cent. “The first 0.5 per cent after the 3 per cent is unconditional, while the next 1.5 is with conditions,” he said, adding that the State’s borrowing limit is Rs 3,000 cr.

As per the State’s budget figures the State borrowed around Rs 2,600 cr in the financial year 2019-20. In view of the mining ban the State’s finances were already reeling with a Rs 2,000 cr annual deficit. The lockdowns, in the wake of COVID-19, have further dented the State’s economy.

Chief Minister Dr Pramod Sawant had recently announced austerity measures and banned fresh recruitment, foreign and domestic tours until December.

The government has also decided to defer sanction of capital expenditures except that which is partly or fully funded by the Centre and to put off project-specific borrowing till December.

Though the government hiked excise duty on liquor by 50 per cent, sales have fallen appreciably because the tourism and hospitality sectors have been hit hard by the lockdown restrictions.