his year the exercise of seeking pre-budget suggestions was a bit different than the previous years as the pandemic took its toll here as well. The State government wanted suggestions from all sectors separately as the pandemic taught that each and every segment of industry has a crucial role to play in society building.

Normally, barring a few, many industries would club together with a larger bodies like the GCCI, CII, Assocham etc, to place their grievances but this year many organisations like the restaurants and bar owners, Travel and Tourism Association of Goa, Goa Pharmaceutical Manufacturers Association, Goa State Industries Association, Business Network International Goa, Verna Industries Association, Goa Technology Association, etc, gave their recommendation to the State government in anticipation that it would study and then formulate the budget.

Since there was vote on account for 2019-20 which was presented by ailing Manohar Parrikar, the industry never got an opportunity to present their recommendation. However, the 2018-19 pre budget submission by industry body like the Goa Chambers of Commerce and Industry (GCCI) it was the first State budget after the transition from the old VAT regime to the new GST regime. In spite of the initial hiccup in the implementation, the industry felt that the trade and industry in Goa coped up fairly well with the regime change.

In 2020-21, which ultimately landed into the uncertain territory of pandemic and lockdowns, the entire finance scenario fell like an apple cart as nearly all businesses were affected very badly. This happened unexpectedly barely few weeks after the announcement of the budget. The industry had placed several demands calling it “facing the rough patch during 2018-19”, not realising that the coming year (2020) would be the worst of all times.

The recommendation which was submitted by the GCCI before Manohar Parrikar in 2018-19 mentioned that “We wish to bring to your kind notice that the industry in Goa is going through a lean patch and is depending upon the government to extend some tax incentives and improvements in the infrastructure, which is badly needed and cannot be neglected much longer. Industry is the largest contributor of tax and non-tax revenue to the State. However, every time a budget is announced there is hardly any allocation for improvement of industry related infrastructure or incentives.” This phenomenon has always existed that the industry will ask for sops and government would take their call on the basis of revenue collected.

However, after the year 2020-2021 budget was announced, the President of the Goa Chambers of Commerce and Industries (GCCI), Manoj Caculo said: “Some of our suggestions are accepted like the one for dispute resolution for old VAT and Service Tax matters. This will help industry get rid of old litigations and help government mop up revenue. However, the hike in excise fees for bar licences will harm the tourism sector which is already under stress. No special allocation has been made to improve industrial infrastructure which was expected. Focus on skill development is a welcome sign which will improve employability of Goan youth.”

Former President of GCCI and Chairman of Vibrant Goa Foundation, Nitin Kunkolienker was of the view that the consumers must be kept a priority while framing a budget. He added that the government has to create a task force on many issues, even on revenue generation with a simplified process and there are so many unsolved litigations.

“We cannot create jobs without engaging and help developing the private sector. If 36 per cent of the amount is spend on paying salaries and pensions, then only 28 per cent is left for developmental work and the balance is sent on debt clearance. We have to now work on expeditious economic development strategy in Goa. The focus should be in planning as it has totally failed, and not making money through conversion process,” said Nitin Kunkolienker.

Rajkumar Kamat, President of Vibrant Goa Foundation and Executive Director of BNI, expressed his satisfaction that whatever he had presented as President of Vibrant Goa Foundation before the Chief Minister, also the Finance Minister of Goa, more or less has been addressed to.

However, Kamat added that the CM apprenticeship scheme is welcome as the aim is to create more jobs both in the industry and government but the government really needs to work on ease of doing business in the state. He appreciated the move by the government in the field of education but wanted that these would be facilitated through private enterprise.

He also added that the move to set up entertainment park is a great step not only to draw tourists, but also the local Goans. On expo cum convention centre Mr Kamat was happy that it finally came up. “Overall and excellent budget but it is very important that the entire government machinery is galvanised into action and implementation starts without any delay,” added Rajkumar Kamat.

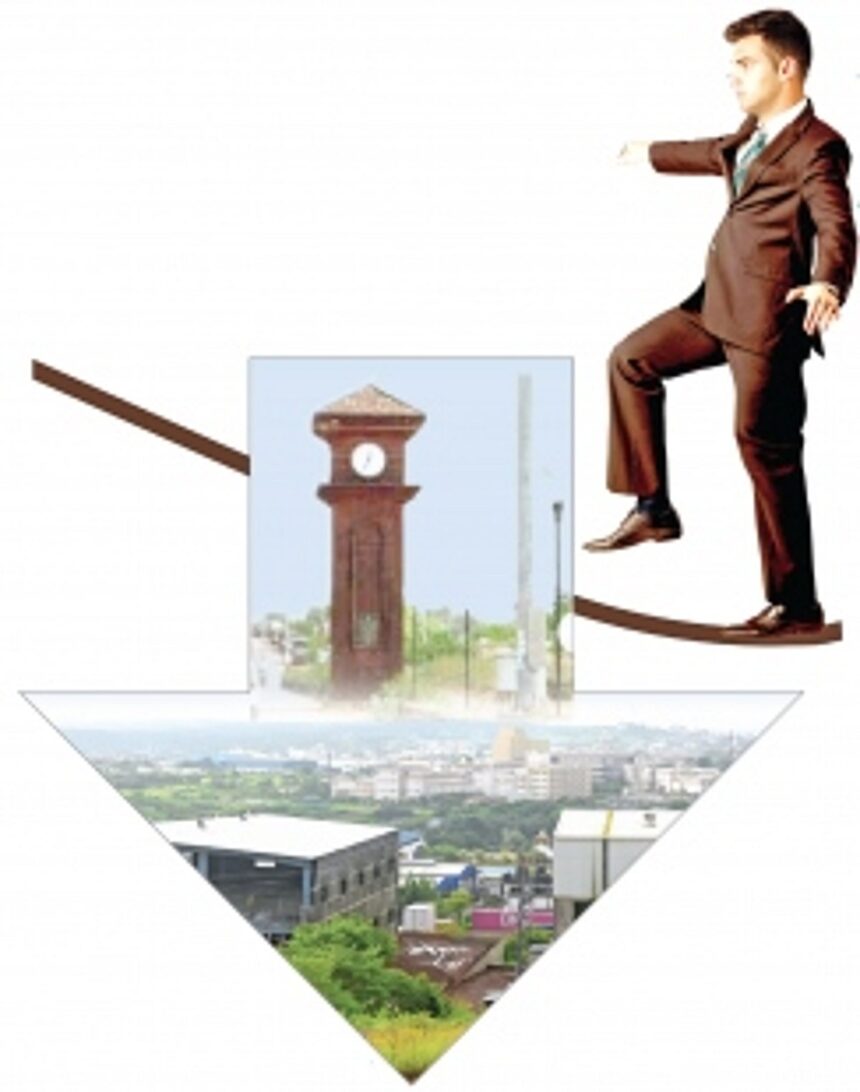

The above reaction clearly stated the industry expected more. The year 2021 with the aftermath of pandemic, the industry which has suffered a great loss is also aware about the shortfall in revenue and financial situation of the State government, which is not very healthy. Surely the expectations are higher and it will be tough for the State government to do the balancing act and satisfy the already aggrieved industry.

Also, 2021-22 will be different as this could be the last proper budget before the upcoming 2022 state assembly elections in Goa. As perceived and expected next year it could be a vote on account as the elections would be slated for February-March next year. Also, this year budget will actually see the aftermath of the COVID pandemic which has crippled the economy not only of Goa but of the entire India and the world-over.

In fact, GCCI in its letter to the Chief Minister Pramod Sawant who is also the finance minister was very candid by mentioning that, “We are aware that for last several years, post the ban on mining, the State’s revenues have been under severe strain and hence the industry has not been demanding much from the government.”

However, common effluent treatment plants, common hazardous waste treatment and disposal facilities, common fire fighting system (pump room, hydrants), new and strong bridge at Borim, truck terminals at industrial estates, better water and power distribution systems etc are some of the urgent needs of the industry. All these demands are related to healthcare, sanitation, logistics and essential services and in all likelihood it is because of the learning from the pandemic.

“You are aware that the industry in Goa, which was already reeling under the impact of a long drawn global economic crisis, has further suffered due to the worldwide lockdowns necessitated by the COVID pandemic and is depending upon the government to extend some tax incentives and improvements in infrastructure that is badly needed and cannot be neglected much longer,” added the GCCI recommendation which was presented to the Chief Minister on March 2 this year.

They also suggested that to attract investments into the State, new units which go into commercial production should be given fresh incentives. This will help to generate investments in the State which has not happened for a quite long time. The government in its own wisdom should devise new incentives to such new units either in the form of employment subsidy, transport subsidy, or any other direct, indirect incentives.

To facilitate the above it also suggested a formation of three to five-member Task Force, under the Chairmanship of Chief Minister or Chief Secretary to assess the problems faced by the existing units in Goa and also to assess possibilities of reviving the closed units.

Realising that mining was the major bread-earner for Goa and its uncertainty thereof, GCCI suggested that the revival of mining and related activities and earning of revenue from there is uncertain to say the least. “Under the circumstances, only manufacturing sector and tourism can provide stability and growth to the State economy. In this light we put forth before you a few suggestions which may kindly be addressed while presenting the forthcoming state budget for 2021-22.

Among the major issues the industry body also touched upon support to local entrepreneurs and business community by ensuring that at least 50 per cent of all government departments and corporation’s requirements are sourced locally. “However, we often come across instances when various government departments, corporations find different ways of denying the benefit to local entrepreneurs and give business to parties outside the State. One such way to debar Goan entrepreneurs from participating intenders floated by the government departments is to set conditions which are impossible for the Goans to meet,” lamented GCCI.

“We request you to kindly formulate a Procurement Policy for the state that will ensure that at least 50 per cent of all government requirements is reserved for Goan entrepreneurs. This will provide a big boost to all start-ups and other businesses in Goa. This will also help in generating revenue as well as jobs for local youth. Government should implement IT Policy provision to allot at least 50 per cent of all government IT business to local start-ups and other IT companies in Goa,” stressed GCCI.

On stamp duty, the industry demands that any conversion from partnership firm to Limited Liability Partnership (LLP) or to Private Limited Company with same partners, directors should be exempt from stamp duty. In this case there is no transfer for any consideration. It is merely a vesting of assets from persons operating under one legal status to the same persons operating under another legal status by operation of law and does not result in a transfer of assets.

Industry feels that the hospitality industry requires innumerable number of licenses to run a resort and they have to be renewed on annual basis. Considering the number of such establishments in Goa, the government departments are occupied in processing these applications most of the time, while on the other hand, it creates hardships to the applicants.

“In order to solve this problem at both ends, it is proposed to extend the validity of all these required licenses to five years as is the case with the licenses of the central government Ministry of Tourism. The state can charge and collect five times the prevailing annual fees to safe guard its revenues. This way thousands of man hours of the government departments will be saved, the cost involved in annual renewal of these licenses will be saved, the revenues will be safe guarded and the applicants will be relieved of the hardships. It is estimated that by adopting the above suggestions the administration will save expenses to the tune of Rs 50 crore per annum in terms of saving of man hours and cost of stationary and other communication expenses.