HERALD: Who much inventory and land bank does Gera have in Goa? What are your plans for the future?

KUMAR GERA: Currently we still have something to sell, we have about 800 units in three projects out of which about 700 plus have been sold. So it’s a very small 11 per cent which is still in the market. We are now looking very aggressively for new projects to develop because I found a lot of messages and customers who are willing to buy or invest for the future in our projects. We are looking as clear parcels which have clean titles which is difficult to find in Goa.

HERALD: What about commercial complexes. How many complexes do you have right now in Goa?

KG: Well we have completed six buildings in plots on Patto Plaza. The other two are at Mala and Kadamba plateau which is ongoing. That’s what we have so far and we have delivered a large number of units.

HERALD: How do you see the current slowdown?

KG: The current slowdown is real. There is a slowdown nationwide. I feel that demonetisation and RERA have very clearly separated the committed developers who are there for the long term from those who are into the short term play. The short term players are now out of the market. However, those with a good track record and have shown commitment to timely delivery with quality are seeing improvement in business.

HERALD: How and why do you say that business has improved?

KG: This is because when members of the small fragmented players are moving out from this sector, thanks also to RERA for this as it have been a great thing not so much in Goa as yet but it has played a great role in leveling the playing field. What was happening before that is the fly-by night operators were quoting exhorbitant rates and people used to go with a notion that higher price would mean better quality. But with RERA coming it no false promises can be made. For us it is wonderful situation as I am doing new things and raising the bar and all such fly-by-night operators will also have to do the same under RERA.

HERALD: You said RERA in Goa has not been seen in full swing.

KG: I would like to see RERA in Goa to move forward at a faster rate for its implementation. It is a wonderful piece of legislation which the government has brought and Goa is a little slow in its implementation as compared to states like Maharashtra, Gujarat etc which have really gone in the big way and much faster by implementing it fully. Yes RERA needs the infrastructure and I hope the state government will provide the means to be able to run this. This RERA will protect buyers and give them the confidence to buy in the secured investment environment.

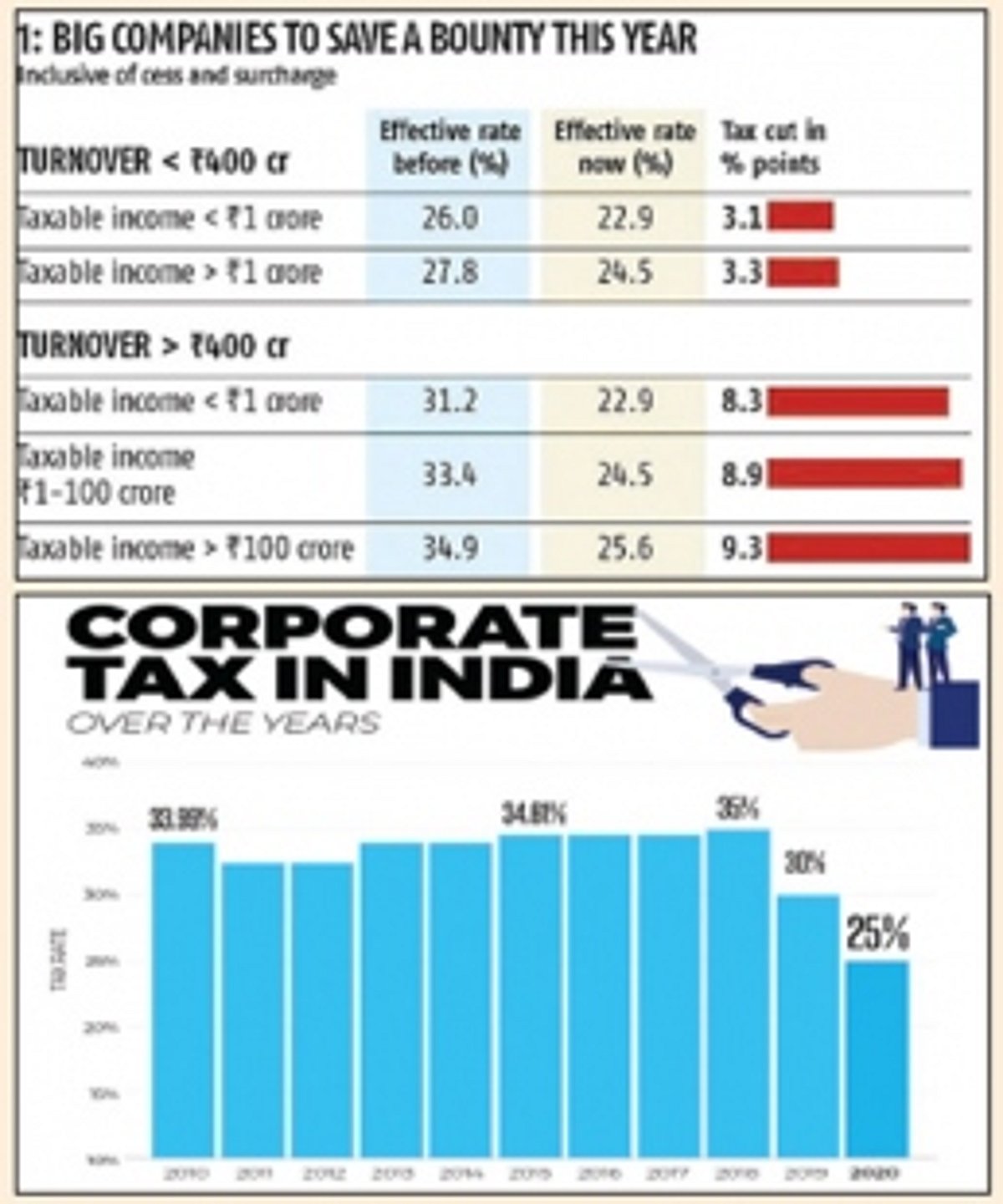

HERALD: How do you see the real estate sector benefit from the recent corporate tax cut?

KG: The result of this is more importantly in market sentiment which had become very negative in the recent past. In Goa soon after the mining problem, demonetisation, RERA, expectations of prices coming down further etc led to a complete negative mindset. Now I feel that this mindset is going to change. Why? Because now the feeling is that there will be more money to invest. When there is more money to invest in the industry and when we are giving the new industry an incentive of just 15 per cent of corporate tax, it was unheard of in the international market a lot of investment is going to come. This may take a little bit of time but it has impacted the sentiment the moment it was announced. This sentiment leads to a belief that there will be job creation, increment in salaries, job is safe, because the company will have the money to re-deploy and take chances with. All these sentiments have a huge impact to real estate for the better.

HERALD: You are talking about the supply side. How about the demand side which is the ultimate buyer who still needs cuts in income tax rates to have money in their pocket to buy?

KG: There are different types of buyers. There is a buyer who has a need and he or she has to buy. The buyer is under pressure from their family members to purchase a property. If the price is too high for the buyer, he or she has no choice if the price is not coming down. The buyer may also try to go further from the downtown city or by 10-50 square meters less to fit the budget. Yes, there are less buyers in the luxury segment as they have the money and they can postpone their willingness to buy a property as it may not be their immediate or urgent need. There are multi factors which come into play in property buying. The interest rates in the banks are also coming down and they will come down.