The Automobile sector is probaby going through one of its worst periods in recent times.

Issues like demonetisation and implementation of Goods and Services Taxes (GST) had its affect long ago and subsequently the sales had improved but then the sudden slump for the last 5-6 months. Time is running out rapidly and a lackadaisical approach to this problem may lead to massive job losses.

A minimum of 30-35 per cent drop in the sales has been witnessed by several dealers and some of them have even shut their shops in Goa leading to joblessness. Various offers and incentives floated by the dealers by cutting their own profit margin has also not paid dividends. It seems the buyers are playing a role of wait and watch.

In the June report of Federation of Automobile Dealers Association (FADA), the President of FADA, Ashish Harsharaj Kale said, “Despite starting the month with a positive outlook and hope, the monthly sales ended in de-growth due to continued liquidity tightness and a much-delayed monsoon. Despite Inquiry levels being reasonably strong, retail sales got affected as consumer sentiment continued to be weak and purchase postponement was seen across all segments.”

Kale further added that with slowdown in the economy and liquidity crunch, the vehicle sales continue to reflect downward trend. This adds to the pain felt by the dealers with piling up of stocks. The continuous up-gradations in safety regulations coupled with emission norms up-gradation leading to BSVI are more than welcome, but this is now coming at the cost of affordability. This is leading to a quantum jump in vehicle price and thus results in further postponing of a new vehicle purchase.

The declining sales have had a severe impact on the automobile manufacturers who are reportedly forced to cut down their production by more than 30 per cent. This has also adversely impacted the Original Equipment Manufacturer (OEM) suppliers in different categories. Both these sectors are expected to see huge number of layoffs in the coming months.

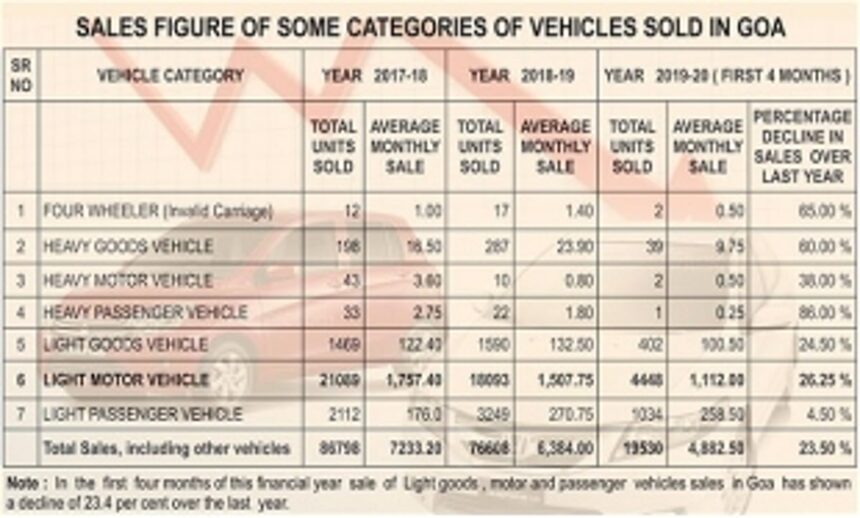

The situation in Goa too is very similar to the one prevalent in the rest of the country. Although there are no auto or OEM manufacturers in Goa, all of the 29 two-wheeler and 26 four-wheeler dealers in the State are reporting a decline of more than 24 per cent in the vehicle sales during the first four months of this year as compared to last two year (See Chart). If this trend continues, many of the dealers will be forced to close shop leading to loss of jobs.

In view of the above scenario the State government will have to be pro-act and give some relaxation in terms of Road Tax, particularly during the forthcoming festival season, so that the sales get a boost and the automobile dealers are able to tide over this difficult situation and subsequently jobs are saved.

Evancio Quadros, CMD, Quadros Group of Companies, also Quadros Motors said, “In last eight months the auto industry has gone down by at least 40 per cent. Government needs to take all auto industry stakeholders into confidence before taking any drastic steps like BS IV, BS VI etc. Dealers lost so much of money and in the bargain lot of dealerships in the country closed down leading to joblessness. Now we have BS VI. How can the manufacturers do these changes so rapidly? I have been told that BS VI does not even exist in US and Europe. Customers now are asking for BS VI which is being implemented from April 2020. So if BS VI engine is not available now the customers will not buy and they will wait. Also, during the festive season if the sales pick up a bit it will not be able to compensate the yearly loss.”

Prashant Joshi, president Goa Automobile Dealers Association (GADA) and Chairman FADA (Goa Chapter) said that, “Most of the dealerships operating in rented premises were closed down as they could not meet the increased leasing payment while upfront GST payment added at least 20 per cent to their capital cost that badly impacted the business.”

Goa has a total population of 15 lakh does not have a very robust transport system. The new age ride sharing companies like Ola and Uber are also not allowed here.

Manoj Caculo, president of the GCCI and CMD of Caculo Group which includes Caculo Motors was concerned about the dipping trend in the automobile sales market.

“Scientifically we do not know the reason of this slump. We can only guess. I think it is due to the change in the entire transportation sector and it happened in couple of other countries where people are shying away from owning a car because of the convenience of these app-based taxis, which can be hired at a push of a button and avoid inconvenience of congestion, parking, maintenance etc. In Goa there are some outlets which have already shut. Going by this trend, it looks a very bleak future. I think the picture should be clear by the end of this financial year as generally in Goa the buying season starts now. However, I have never seen such a drop in business in Goa and according to me the dip is around 30 per cent,” said Caculo.

Managing director of Alcon Enterprises and Counto Motors, Aakash Khaunte said, “The push which the government of India is giving to electric vehicles could be one of the reasons apart from the high GST which has impacted customers. Delayed input credit to dealers has also led to liquidity crunch. Earlier the C-Form was two per cent, now under GST it is 28 per cent tax. However, the electronic vehicles to hit Goa road full swing will take another 5-10 years. Goa being a small state, the number of customers is less and they too seem to be in the mode of wait and watch, expecting some relaxation on GST. In Goa the dependency on privately owned vehicle is pretty high but since we have a lesser customer base, the units rolling out are also less and there are very few first time buyers. Everyone is facing a drop of at least 30 per cent and luxury cars sales are more badly hit.”